The noise

-

The UK economy narrowly avoided a recession in 2022 as economic growth in Q4 was flat. This is despite a sharp 0.5% fall in economic output in December, after the cost-of-living crisis and industrial action across the UK hit the economy. Despite dodging a recession, the UK is the only G7 country that is yet to fully recover output lost during the pandemic, 0.8% smaller at the end of 2022 than it was at the end of 2019.

-

US hiring surged in January as nonfarm payrolls increased by 517,000 in January, following a 260,000 gain in December. The unemployment rate also reached a 53-year low, dropping to 3.4% in January. The figures beat all economist estimates and showcase the resilience of the job market despite an overall uncertain economic outlook and rising borrowing costs.

-

Trafigura Group, one of the world’s largest commodity trading houses is facing more than half a billion dollars in losses after discovering metal cargoes it bought didn’t contain the nickel they were supposed to. Nickel has become a popular metal among fraudsters as a result of its high value ($500,000 per shipping container) and large trading volumes, with containers being filled with much-lower value materials instead.

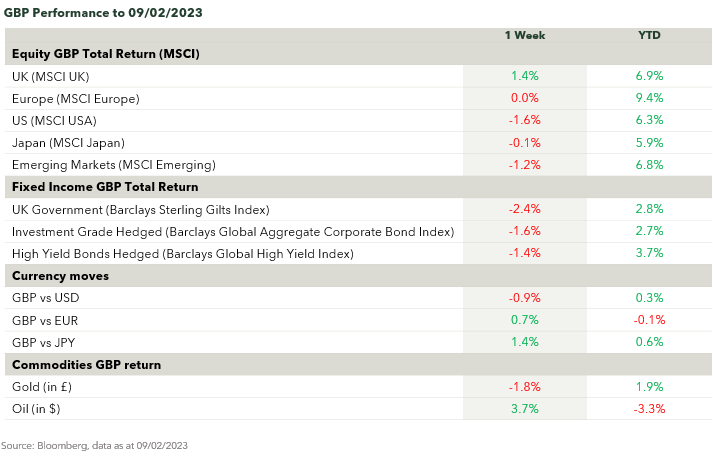

The numbers

The nuance

Bond yields rose slightly this week as higher interest rates have so far failed to impact the US job market statistics. Despite ongoing corporate restructuring announcements, the official statistics point to continued high levels of employment, which is often (mistakenly in our view) pointed to as a source of inflation pressures. Equities stalled in their advance, with next weeks scheduled valentines day release of the latest US inflation figures a source of concern for optimistic investors.

With interest rates in the UK at 4%, and in the US just shy of 5%, investors have a low volatility alternative, and can be paid to wait and see how the situation evolves. Long term goals can not only be met, but potentially enhanced by setting aside a portion of your portfolio in liquid assets in case valuations present the opportunity to boost returns.

Quote of the week

“I play but wow! Nowhere near your level”

Scott Stallings

American golfer Scott Stallings had to wait a little longer than expected this year to receive his Masters invite, as it was sent to another man by the same name.

Checking his mailbox five times a day eagerly awaiting the arrival of his coveted green envelope, he received a message via social media from the other Stallings. “Hi Scott, my name is Scott Stallings as well” he wrote.

“My wife’s name is Jennifer too! I received a FedEx today inviting me to play in the Masters Tournament. I’m 100% sure this is NOT for me. I play but wow! Nowhere near your level”.

The non-professional golfer Scott Stallings believed the mix up was likely a result of them and their wives having the same names, and living in the same state

The 37-year-old Stallings is ranked 54th in the world. He is a three-time winner on the PGA Tour, with his best result at the Masters coming in 2012, when he tied for 27th.

Source: Reuters

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested. Any views expressed are based on information received from a variety of sources which we believe to be reliable, but are not guaranteed as to accuracy or completeness by atomos. Any expressions of opinion are subject to change without notice.