The noise

-

The Bank of England raised UK interest rates by 0.5%, to 4%, while signalling that rates may now be nearing their peak. The US Federal Reserve similarly raised its target for its benchmark rate by 0.25% to a range of 4.5% to 4.75%, with the Fed committee also showing signs that the end of the hiking cycle may be in sight. The European Central Bank lifted interest rates by 0.5%, taking it to 2.5%, as its governing council intends to rases rates by another 50 basis points in March.

-

UK housing prices fell for the fifth straight month in January according to the Nationwide Building Society. The price of the average property last month was £258,000, down by 0.6% on December and only up 1.1% from January last year. Strong economic headwinds and the unaffordability of mortgages will continue to make it difficult for the housing market to regain any momentum in the near team.

-

475,000 union members were on strike in the UK on Wednesday, the worst UK strikes for a decade. Almost 9% of schools were shut as a result, as several of the major train stations in London were completely closed. Wednesday’s mass strike also saw civil servants across 124 government departments, London bus drivers, and university lecturers take part in a stand over pay not keeping pace with inflation.

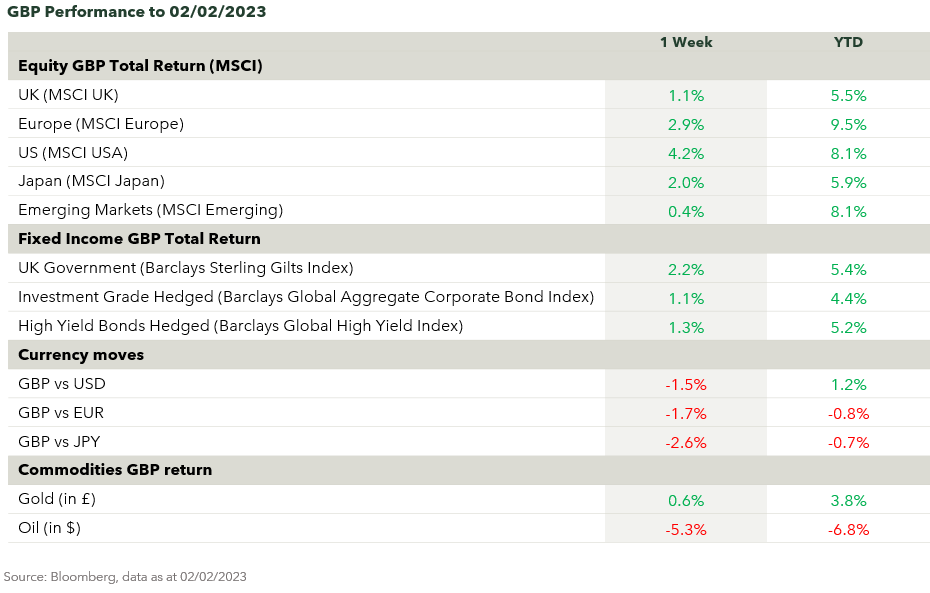

The numbers

The nuance

Expectations of a soft landing continue to build as investors extrapolate short term trends and selectively pick through the data. As corporate earnings reports for last year arrive along with forward guidance for this year, we have seen a continuation of the trend for analysts to downgrade earnings expectations. Very little earnings growth is expected for 2023 and should the trend continue, profits may turn out to be lower than last year. World trade volumes have declined, global manufacturing surveys indicate contraction, US home sales have collapsed, and corporate restructuring announcements are common.

In contrast there are many resilient data points. The official unemployment number in the US is still below the historical natural rate of unemployment, consumer credit also continues to grow at double digits. US home prices have yet to decline and the US government continues to engage in deficit spending at record levels. After last June's explosive CPI increases, the subsequent 5 months official inflation figures have increased at an annualised 1.88%, providing the spark of hope that the fight has been won.

While it is possible that consumer price index growth continues to moderate, it is also possible that this may be a transitory period of lower price rises. The US is on course for a final increase to 5% interest rates in March, likely to be sustained unless the economy deteriorates rapidly. The fixed income market view of central banks pivoting to cut rates this year seem misplaced against the equity market view of a soft landing. In times of such uncertainty it is wise to keep an open mind relating to the future, and ensure that your long term investment plan succeeds under a broad array of possible outcomes.

Quote of the week

It would be even more convenient if you could click on a name to look up its meaning and pronunciation”

Theresa Clare

As more and more people are meeting their special someone via dating apps, the very same technology could well help you settle on a baby name.

Baby name app Kinder presents you with a number of options, which you can choose to swipe right (yes) or left (no) on. Rather than potential partners, Kinder presents you with a number of baby names to choose from. When both you and your partner swipe right on the same name, you match, collating a list of names you like in common.

Launching in 2018, the fun yet very useful app has received stellar reviews from users, scoring 4.5 stars out of 5. “This app is super simple which is fun. It’s run by one person, so it makes sense it doesn’t have tons of bells and whistles” said a 5 star awarding user.

It can even introduce you to names you didn’t know or hadn’t even thought of. A clearly satisfied parent says “I found a whole new name that I love and has a good meaning – Eliana”.

With over 18,000 names in its library that is pulled together from over 80 languages, there’s a chance you may end up falling for a lesser-known name.

Source: The Mirror

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested. Any views expressed are based on information received from a variety of sources which we believe to be reliable, but are not guaranteed as to accuracy or completeness by atomos. Any expressions of opinion are subject to change without notice.