The noise

-

UK household confidence has had its sharpest rebound in almost two years, as signs start to emerge that the worst fight against inflation in 40 years is easing. Market Researcher GfK’s consumer confidence indicator jumped to a 10 month high, although remained at historic lows caused by the cost of living crisis.

-

US claims for unemployment benefits unexpectedly fell, signalling an uncompromising tightness in the labour market. The US labour market has maintained millions of open positions, low unemployment and robust job creation, and its strength is seen by Fed policymakers as a key factor in inflation remaining elevated.

-

IAG, the airline group that owns British Airways, Iberia and others announced it was enjoying strong bookings through the first couple months of 2023, following reporting of its first annual profit since the pandemic started. They are anticipating full restoration of 2019 levels of capacity by Q4 of 2023, these expectations being mirrored by Air France KLM. These are promising signs for the travel industry that will have cross sector benefits.

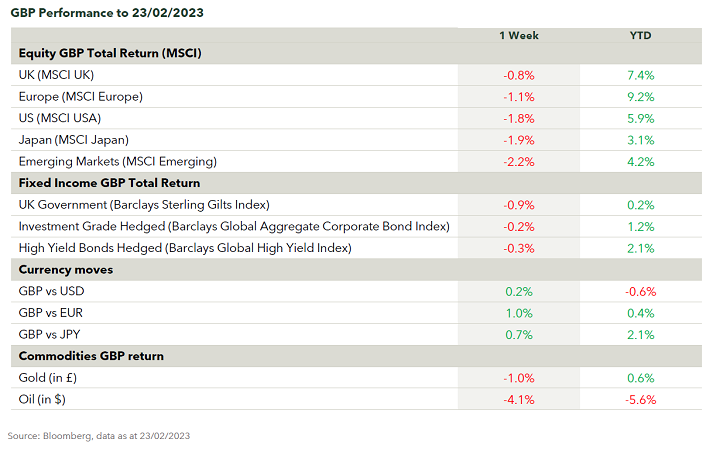

The numbers

/Screenshot-2023-02-24-135152-(1).png)

The nuance

Bond prices fell again this week as yields rose in response to economic data, which continues to remain strong in the face of tighter monetary policy. US fourth quarter GDP was revised down slightly but still printed an expansionary number. At the same time jobless claims remain muted despite the wide spread announcements of corporate layoffs. The core personal consumption expenditures statistic, the Federal Reserve's favoured measure of inflation (as it’s structurally the lowest) was revised higher. If the intention of higher interest rates is to raise unemployment, slow economic growth and then ultimately reduce the rate of inflation, this data set evidences that more needs to be done. The move in the bond market reflects this.

Common wisdom a year ago was that any meaningful interest rate hikes would quickly be reversed as the economy is so laden with debt it would be unable to shoulder the burden. The exact level of interest rates that tips the economy in to recession and tames inflation is not known, and central banks continue to feel their way through the dark, hoping to hit a level that softens inflation without being the catalyst for a recession. Having an investment plan that can react to either scenario is sensible, as is balancing potential long term reward with the short term risks to capital.

Quote of the week

“There’s going to be people who say, Olive oil in coffee? But the proof is in the cup”

Howard Schultz

Starbucks CEO

Starbucks is releasing a new range of olive oil infused drinks in its 20 Italian stores, with plans to brings the drinks to the UK later this year.

CEO Howard Schultz said the idea struck him while travelling in Sicily last year. He started adding it to his coffee and found it produced “an unexpected, velvety, buttery flavour that enhanced the coffee and lingers beautifully on the palate”.

The new range, termed the Oleato olive oil range, includes a latte, cold brew and the “Oleato deconstructed”, which pairs espresso with olive oil “infused with a luxurious passionfruit cold foam”.

Starbucks opened its first branch in Italy in 2018, causing outcry and prompting calls for a boycott. Protestors even set fire to palm trees planted by Starbucks in Milan.

Source: Sky News

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested. Any views expressed are based on information received from a variety of sources which we believe to be reliable, but are not guaranteed as to accuracy or completeness by atomos. Any expressions of opinion are subject to change without notice.