The noise

-

The Bank of England has raised its benchmark lending rate by a quarter percent to 4.25%, the highest since 2008 in a move that was widely expected. The Bank of England’s 11th straight rate rise follows similar hikes from the US Federal Reserve and European Central Bank, increasing by 0.25% and 0.5% respectively.

-

UBS agreed to buy Credit Suisse in a deal brokered by the Swiss government, aimed at containing a crisis of confidence that was starting to spread through global financial markets. UBS will be paying $3.3 billion for its rival in an all-share deal, with chairman Colm Kelleher being very clear that they intend to cut a significant number of jobs. The deal also saw the rare occurrence of Credit Suisse bondholders being made worse off than shareholders.

-

Hindenburg Research, a firm we discussed in our 27th January edition of the weekly has come after another company. Their latest report alleges that Block (formerly Square), the payment company, has ignored widespread fraud. They claim that they have inflated user metrics, causing the stock to fall as much as 22% on Thursday, closing 15% down.

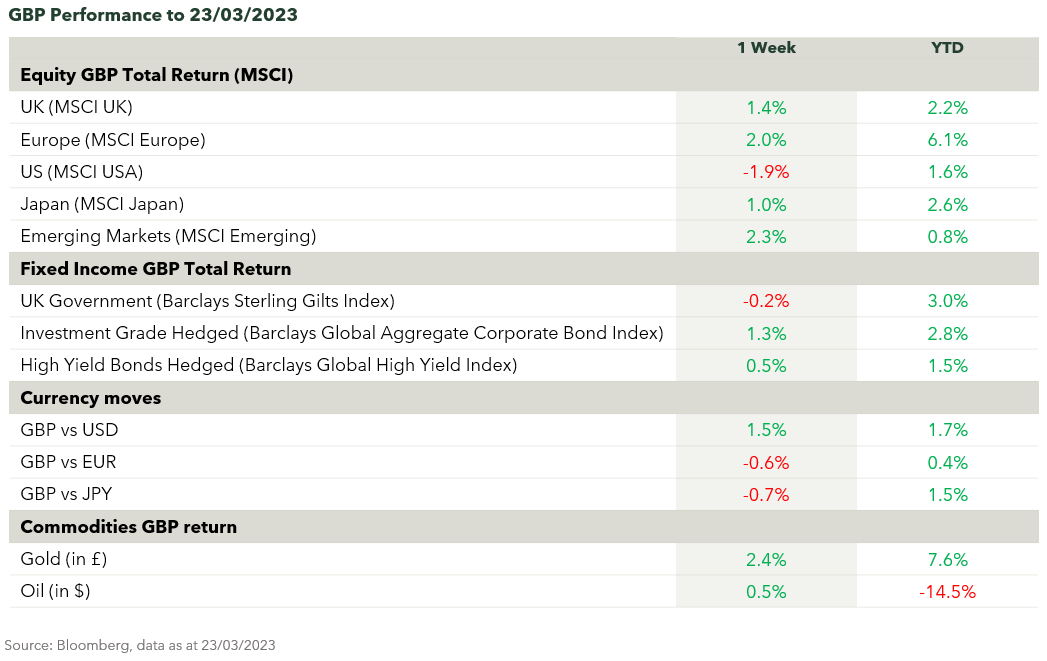

The numbers

/Screenshot-2023-03-10-130611.png)

The nuance

This week saw the major central banks go ahead with further interest rate increases, despite the turmoil we’ve seen in the banking sector. The Bank of England and US Federal reserve opted for a widely expected 25 basis point lift, with the European Central Bank pressing ahead with a 0.50% increase. The Bank of England’s decision could be the last of 11 successive hikes, although the underlying price pressure created by current labour market conditions could pose a threat to that.

The swift and decisive actions of the Swiss national bank in securing UBS’s acquisition of Credit Suisse will hopefully calm fears of a new banking crisis. To push the deal through the Swiss government will have to change the law, allowing them UBS to acquire Credit Suisse without a shareholder vote. Given Credit Suisse is classified as one of just 30 “systematically important” lenders by the global Financial stability board, it was clear that something needed to be done. The most curious decision made by the Swiss was triggering a complete write-down of Credit Suisse’s risky bonds. This means that these bondholders will receive no compensation for the acquisition, while shareholders will collectively receive about 3 billion francs. Ignoring seniority in the capital structure has obviously not gone down well with investors, and it will be interesting to see the impact of this on the wider AT1 bond market.

Quote of the week

"I'm sure I'll get some comments like mate, you're going the wrong way”

Tom Harrison

London Marathon Runner

Avid runner Tom Harrison is set to complete the London Marathon backwards in support of Ukrainians affected by the war. Having previously crawled the course dressed as a gorilla, he has set himself the goal as a means of “looking over my shoulder for Ukraine”.

The 46-year-old is no stranger to taking on unique yet challenging feats, having walked 263 miles in 15 days from Lands end in Cornwall to Parliament Square in London in September 2022.

His £2,000 target to secure his place in the marathon has already been surpassed, having raised most of the cash through cake sales.

Tom will start from the back to avoid any potential crashes with fellow runners. He hopes that his unique way of running the marathon will draw attention to his cause, although he thinks he will “probably have to put something on my back which explains what I’m doing.”

Source: Sky News

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested. Any views expressed are based on information received from a variety of sources which we believe to be reliable, but are not guaranteed as to accuracy or completeness by atomos. Any expressions of opinion are subject to change without notice.