The noise

-

Friday last week saw the largest US bank failure in more than a decade, as a $1.8 billion loss led to a run on the bank for Silicon Valley Bank. SVB was home to cash belonging to half of all venture-backed start-ups in the US. The issue they faced was rising interest rates, which left them burdened with low-interest bonds that can’t be sold quickly without incurring big losses. US authorities pledged to fully protect all depositors’ money in an effort to strengthen confidence in the banking system.

-

Credit Suisse received a potentially lifesaving $54 billion credit line from the Swiss National Bank on Thursday, as confidence in the bank fell to record lows following the SVB failure. This move should calm investors and clients’ fears, although will do little to bring back the assets that have already left, with the bank seeing net outflows of $119 billion in Q4.

-

The Chancellor of the Exchequer presented his Spring budget on Wednesday, confirming an increase on main rate corporation tax from 19% to 25% for profits over £250,000. Perhaps most importantly for our readers, Jeremy Hunt’s budget outlined an abolishment of the pensions allowance, meaning that there will no longer be a limit to how much you can build up in your pension tax free. The tax-free yearly allowance for pension contributions has also been increased by 50% to £60,000.

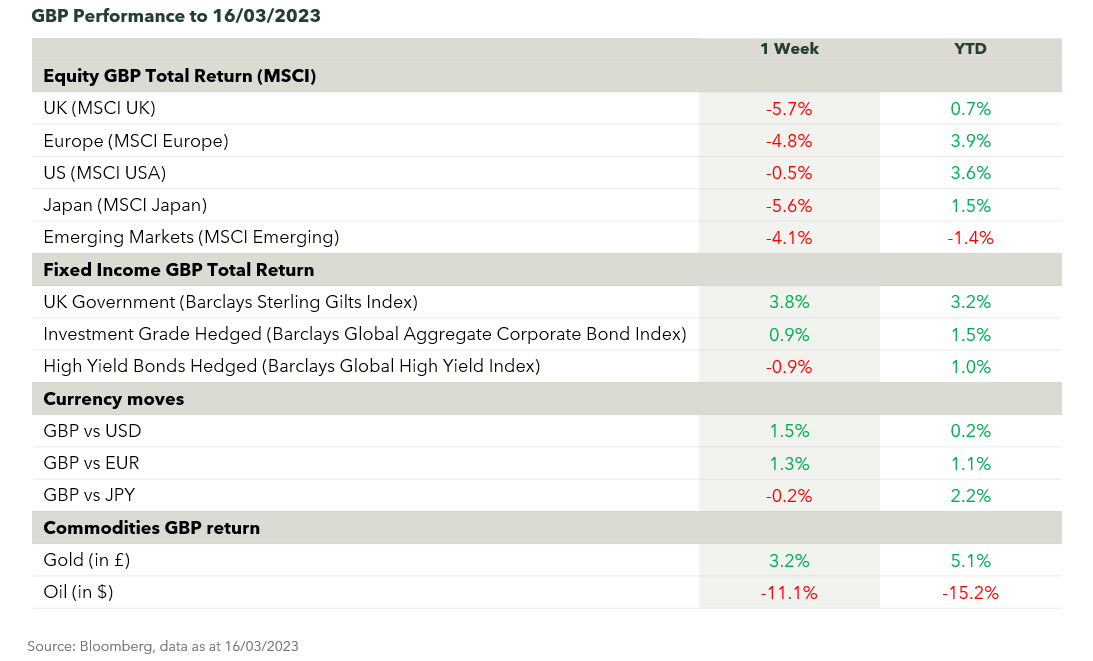

The numbers

/Screenshot-2023-03-10-130611.png)

The nuance

Policy makers had a frantic weekend and came out decisively on Monday with a series of moves designed to calm financial markets, which were bracing themselves for a run on the bank. HSBC acquired the UK arm of SVB bank, the US government guaranteed uninsured deposits, the Federal Reserve offered to overpay for government debt held by banks loaning out par value against paper worth a fraction of the value, and the Swiss National Bank offered a life line of liquidity to Credit Suisse. In the space of 5 days the law was disregarded and overruled in an attempt to quickly staunch the financial wounds caused by central bank's inflation fight.

Equities declined and credit spreads widened, while gold and government bond prices surged. This came as investors assessed the short and long term impacts of the global bailouts, resumption of Quantitative easing, and the abandonment of the inflation fight. Pundits have been quick to claim that these insolvent banks were reckless and negligent, but the truth is more nuanced. Regulators changed the rules during the 2008 financial crisis to allow banks to ignore losses on holdings that they did not intend to sell. Instead a rather innocuous line item appeared on the balance sheets, unrealised losses. Additionally, the risk free designation of Government bonds means that banks can own these with almost unlimited leverage, without being required to hold capital against the positions. It is unsurprising that 12 years of financial repression keeping interest rates at zero encouraged banks to take customer deposits and speculate in government debt, earning a couple of percent interest while paying depositors nothing. The fight against inflation quickly reversed these profits into losses with the banks receiving a couple of percent interest from the government but having to pay depositors increasingly large compensation. Eventually, forced to sell and close out the position, it surprised many that the unrealised losses has wiped out the value of the equity making it insolvent.

Another bank comes to mind which has done the same trade. It purchased significant amounts of government debt which has now declined in price causing losses which has wiped out its equity. The Federal reserve, sitting at the heart of the financial system no longer remits profits to the US government but requires cash infusions to plug its losses. Having restarted QE due to the bank runs, and widely expected to start cutting interest rates soon, the tough love of keeping interest rates higher for long enough to tame inflation have been abandoned. This weeks monthly US inflation number was 0.4%, an annualised rate of 4.8% which will test the resolve of the FED to fight inflation against the backdrop of a fragile banking system.

Quote of the week

“The French Bulldog has seen a surge in popularity over the years, and for good reason”

Gina DiNardo

Executive Secretary, American Kennel Club

Following a 31 year reign as America’s most popular dog, a new top dog has taken the lead! The Labrador retriever has been dethroned by the “playful” and “adaptable” French bulldog.

The American kennel club have said the Frenchies had gone from 14th place in 2012 to 1st in 2022, adding that the registrations for the new lovable animals had increased by over 1000% in that period.

“They make wonderful companions for a variety of people” said Gina DiNardo, the American kennel club’s executive secretary. The kennel club describes the breed as “loyal and devoted towards its master and family, whilst acting fearlessly to safeguard its loved ones in the event of perceived threat.”

Other breeds are also climbing up the ranks, including the American hairless terrier, the Gordon setter, the Italian greyhound and Anatolian shepherd.

Source: Sky News

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested. Any views expressed are based on information received from a variety of sources which we believe to be reliable, but are not guaranteed as to accuracy or completeness by atomos. Any expressions of opinion are subject to change without notice.