The noise

-

The UK will join an 11-nation Indo-Pacific free-trade bloc, becoming the first new member since its creation, in a bid to strengthen economic ties and geopolitical relations, and boost domestic growth following Brexit. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership, which includes Australia, Japan, and Canada, will hopefully give the UK a role in setting regional trade rules over the coming decades.

-

Alibaba announced major plans to split its $220 billion empire into six business units. This major restructuring promises to yield several IPO’s and will allow its main divisions to operate with far more autonomy. Decentralising the company’s business lines and decision-making power, addresses one of Beijing’s primary goals during its sweeping tech sector crackdown.

-

Euro-area core inflation hits record highs in March, rising to 5.7% for the core price reading that strips out volatile items like fuel and food costs. This has handed the European Central Bank with the ammunition it needs to continue with interest-rate rises, having raised its main rate to 3.5% last week.

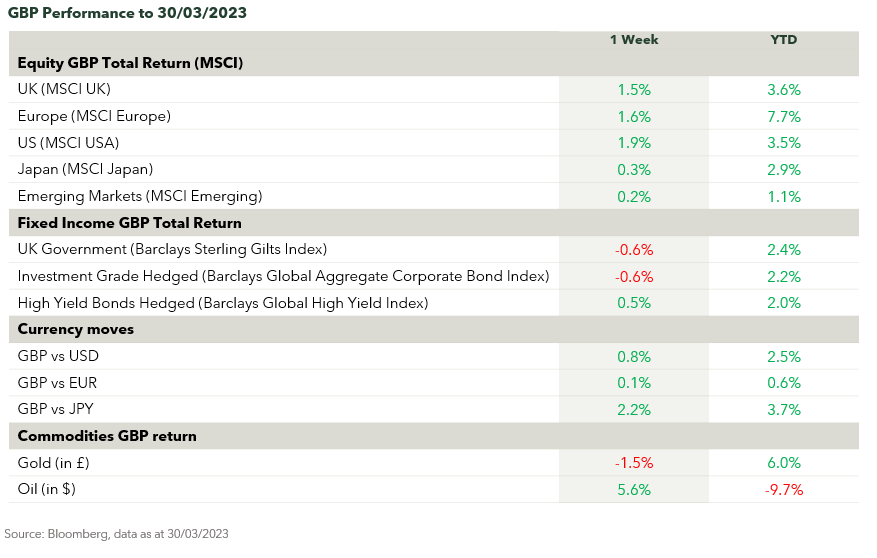

The numbers

/Screenshot-2023-03-10-130611.png)

The nuance

Bonds have been volatile this year, with investors starting to realise that the safe haven status of Treasuries may be starting to show some cracks. We’ve seen the key role they’ve played in the downfall of Silicon Valley Bank (SVB). The US Fed raising rates at their fastest pace in decades in an effort to tame inflation led to treasury prices spiralling downwards. For investors looking to hold until maturity this shouldn’t cause you too many issues. But in the case of SVB, nervous clients pulling their money out could prove an impetus to sell off Treasury holdings.

The collapse of Silicon Valley Bank has led to the realisation that keeping interest rates on deposits near zero is becoming an increasingly untenable proposition. The flight of savings to money market funds has put smaller local US banks in tricky situations, as they are no longer able to lend as much to businesses. Local and regional banks are crucial for small businesses, and this could slow growth and worsen inequality.

Elsewhere, Alibaba’s plan to split into six standalone businesses has breathed new life into the long-dormant Chinese tech IPO machine. It could revive the struggling Chinese technology industry and reinvigorate Hong Kong’s stock market. China’s aim to carve up tech titans and diminish their influence over large sections of the economy will potentially unlock billions of dollars in value, helping to resuscitate the world’s second largest economy following three years of stringent covid measures. China’s resurgence will be one to watch in 2023.

Quote of the week

“I think it would be interesting to try to surf until I’m 100”

Seiichi Sano

Japanese Surfer

A busy company owner for the early part of his life, 89 year old Seiichi Sano has been surfing for the last 9 years. Recognised by the Guinness World Records as the oldest male to surf, he’s ready for other tests.

Having climbed Mount Fuji at 80 and supposedly not being challenged enough, he took up surfing. Although he says he will continue to surf each weekend, he wants to continue challenging himself, saying “maybe I’ll try bouldering”. Bungee-jumping has been ruled out though, as that’s “too scary”.

Determined to continue surfing until he’s 100, Sano says “I think I take better care of myself when I have goals like this. Even now, I take better care of myself than I did before”.

Despite such a late start to surfing, Seiichi Sano shows it’s never too late to try something new.

Source: Associated Press

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested. Any views expressed are based on information received from a variety of sources which we believe to be reliable, but are not guaranteed as to accuracy or completeness by atomos. Any expressions of opinion are subject to change without notice.