Emerging Markets: Risks, Rewards, and Opportunities

In 1981, Antoine Van Agtmael, a World Bank economist at the time, coined the term "emerging markets." The aim was to provide a more positive and attractive label for developing economies. Van Agtmael aimed to attract investors by showcasing the growth potential and dynamism of these transitioning economies. Whilst there are many technical definitions, the term "emerging markets" has since become widely used to describe countries with growing economies that contain some, but not all, of the characteristics, of a developed economy. Two examples of emerging market economies today are India and Brazil.

What is emerging market debt (EMD)?

Emerging market debt refers to bonds issued by governments or companies in emerging markets. EMD can offer several potential benefits such as higher yields (which can be seen as higher compensation) compared to bonds from developed markets because of the additional risks associated with investing in developing economies. EMD can be a useful tool in an investment portfolio to spread risks and create a more diverse portfolio because its performance is less closely tied to global stock markets.

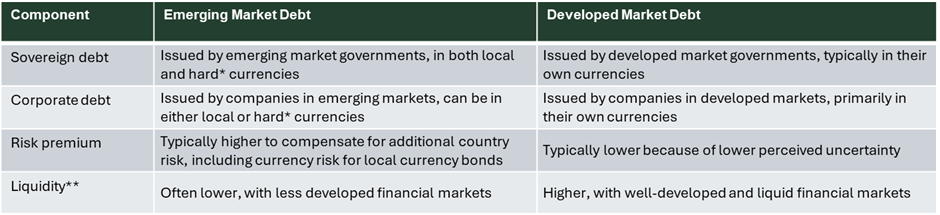

The table below compares the characteristics of emerging market debt and developed market debt:

*hard currencies are currencies that are widely accepted in international trade and financial institutions. They include the US Dollar, Euro, Japanese Yen, British Pound Sterling, Swiss Franc, Canadian Dollar and Australian Dollar. The most typical hard currency for Emerging Market Debt (EMD) to issue bonds in is the US Dollar (USD)

**Liquidity refers to how quickly and easily you can convert an asset into cash without significantly affecting its value.

Source: WTW

As with any credit investment, investors are reliant on the issuer's ability to meet payment obligations. In Emerging Markets particularly, the potential for political and economic instability in developing nations can amplify investment risks. Currency risks are another challenge. If a bond is issued in a local currency, fluctuations in exchange rates can impact returns. A strong local currency boosts investor returns when converted to dollars, while a weaker currency reduces returns.

Market Outlook for EMD

Structurally, the outlook for EMD is improving. Many emerging market central banks are now more independent and responsive to inflation, with some well underway in the rate-cutting cycle (which can boost bond returns). Additionally, banks in these regions have strengthened their balance sheets and have become more prudent in considering systemic risks. Recent outflows from EMD strategies may be attributed to recession fears, the US dollar’s extended rally and global geopolitical tensions. On the other hand, EMD’s appealing valuations and the diversification it offers within a portfolio can make it a compelling consideration for investors.

The Noise

The US JOLTs report, which tracks job openings in the country, showed an increase to 7.7 million in October, exceeding expectations of 7.47 million. The sustained tightness in the labour market we’ve seen through 2024 may be starting to subside, keeping pressure on the Federal Reserve to cut interest rates later this month. Big businesses have traditionally accounted for the majority of hiring and firing in the economy. But now, with big businesses head count still bloated from pandemic hiring, smaller companies may emerge as a key driver of hiring in 2025. In his latest speech, Federal Reserve Chair Jerome Powell expressed optimism about inflation easing and the labour market remaining strong, which supports the case for further interest rate cuts. However, Powell also noted that the recent volatility in data—deviating from market expectations—makes policymaking more challenging, as it creates uncertainty around future economic trends.

UK equities have finally seen a resurgence in investment. In November flows into UK stocks increased for the first time after 41 consecutive months of individuals pulling cash out of UK markets. Investors have shunned UK equities in recent years in favour of global companies such as US tech stocks like Meta or Nvidia. Yet, the tables have finally turned as funds invested in UK stocks attracted a net £317m in November from retail investors. The shift in sentiment comes after the dust settled following the UK budget. Earlier in the year, UK-based investors had withdrawn their money amid concerns that the chancellor would increase capital gains tax — which materialised, prompting a scramble of outflows. However, after the budget, confidence returned to the market. Note that it’s not just the stock market that is seeing more sustained activity in the UK; M&A dealmaking has also picked up pace, particularly in the last week of November, with transactions worth a total of £5.3bn.

The EU Commission has invested €4.6 billion in net-zero and green technologies through its Innovation Fund, which supports decarbonization projects such as electric vehicle (EV) battery manufacturing and renewable hydrogen production. To streamline access to this funding, the Commission has introduced innovative mechanisms like ‘Grants-as-a-Service’ and ‘Auctions-as-a-Service,’ designed to reduce administrative barriers and enhance accessibility. These initiatives aim to accelerate decarbonization efforts across the eurozone, which are critical for achieving the EU’s climate neutrality goals; The EU and its Member States are committed to reducing emissions by at least 55% by 2030 compared to 1990 levels. As a global leader in the net-zero and green space, the European Commission has set a strong precedent for investing in green technology to address rising global greenhouse gas (GHG) emissions.

The Numbers

GBP Performance to 05/12/2024

|

Equity GBP Total Return

|

1 Week

|

YTD

|

|

MSCI ACWI

|

1.2%

|

22.3%

|

|

MSCI USA

|

0.9%

|

29.1%

|

|

MSCI Europe

|

2.2%

|

6.5%

|

|

MSCI UK

|

0.9%

|

11.9%

|

|

MSCI Japan

|

2.7%

|

11.6%

|

|

MSCI Asia Pacific ex Japan

|

1.1%

|

13.3%

|

|

MSCI Emerging Market

|

1.6%

|

10.1%

|

|

MSCI EAFE Index

|

2.0%

|

8.8%

|

|

Fixed Income GBP Total Return

|

|

|

UK Government

|

0.0%

|

-1.8%

|

|

Global Aggregate GBP Hedged

|

0.5%

|

4.1%

|

|

Global Treasury GBP Hedged

|

0.5%

|

3.6%

|

|

Global IG GBP Hedged

|

0.7%

|

4.9%

|

|

Global High Yield GBP Hedged

|

0.5%

|

11.0%

|

|

Currency moves

|

|

|

|

GBP vs USD

|

0.6%

|

0.2%

|

|

GBP vs EUR

|

0.3%

|

4.5%

|

|

GBP vs JPY

|

-0.4%

|

6.7%

|

|

Commodities GBP return

|

|

|

|

Gold

|

-0.8%

|

27.3%

|

|

Oil

|

-1.2%

|

-2.2%

|

Source: Bloomberg, data as at 05/12/2024

The Nuance

It’s time to embrace the seasonal cheer, as the festive season is here! This edition explores what on earth a partridge and a pear tree could have to do with financial markets and the economy.

As Christmas shopping season is well underway, inflation and other economic effects are sharply influencing how much we’re spending on presents this year. The festive CPI figure, the ‘Christmas’ Price Index, is an economic indicator created by PNC Bank which uses the 12 days of Christmas song as a calculus. It has tracked the cost of all the items mentioned in the Christmas carol for over forty years — from the 5 gold rings to the Nine Ladies Dancing. Though the 12 gifts are whimsical, they serve as a good guide on what might cost more this Christmas, and actually closely mirrors the price changes seen in the U.S. Consumer Price Index.

So where will we feel the pinch this year? Overall, spreading Christmas cheer will cost you 3.6% more this year, according to their ‘True Cost of Christmas in Song’ figure.

‘On the first day of Christmas my true love gave to me…’

- 11 Pipers-Piping: Where you may feel the most difference is in entertainment, which sharply rose +15.8% this year, so seeing a play or musical could feel sharply more expensive.

- 5 Gold Rings: Though gold has appreciated by 25%+ this year, it is a good year to get your loved one some jewellery, as the Five Gold Rings have seen another year of no change.

- 4 Calling Birds: Gifting a pet could feel relatively cheaper as the cost of Four Calling Birds hasn’t changed since 2014, setting you back around £470.

The most expensive gift on this list is the Ten Lords-A-Leaping, setting you back £12,255, to buy an hour of ten Lord’s time. This is closely followed by the Seven Swans-a-Swimming, costing about £10,345 for seven swans. Conversely, as the minimum wage hasn’t changed (in the US) since 2009, the Eight-Maids-A-Milking is the most affordable present, priced at a mere £45.

Note, if you want to buy all 12 gifts you need to find a spare £38,872.69, up +5.4% from last year. Turns out if you want to get your true love these items, it comes with a pretty price tag. This is compared to £15,984.68 in 1985, more than doubling in the last forty or so years.

The rising costs of the 12 Days of Christmas gifts offer a whimsical yet telling snapshot of how inflation impacts the consumer. It proves that holiday cheer, while priceless, doesn’t come cheap.

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.

Any views expressed are based on information received from a variety of sources which we believe to be reliable, but are not guaranteed as to accuracy or completeness by atomos. Any expressions of opinion are subject to change without notice.