The noise

-

UK inflation returned to double digits as food prices soared leaving inflation well above the 2% target. The European Central Bank’s decision to hike rates by 0.75% was closely watched by member’s of the Bank of England’s Monetary Policy Committee ahead of their next decision on November 3rd.

-

Rishi Sunak took the reins as prime minister this week, providing fresh hope for an end to market turmoil in the UK, where shares edged higher and gilt yields retreated as he was named PM. Sunak took over from Liz Truss and met King Charles on Tuesday Morning to be appointed and he later gave his first address outside Downing Street promising to fix the mistakes created by Liz Truss. Chancellor Jeremy Hunt announced he would be delaying the next fiscal statement from the end of the month to November 17th.

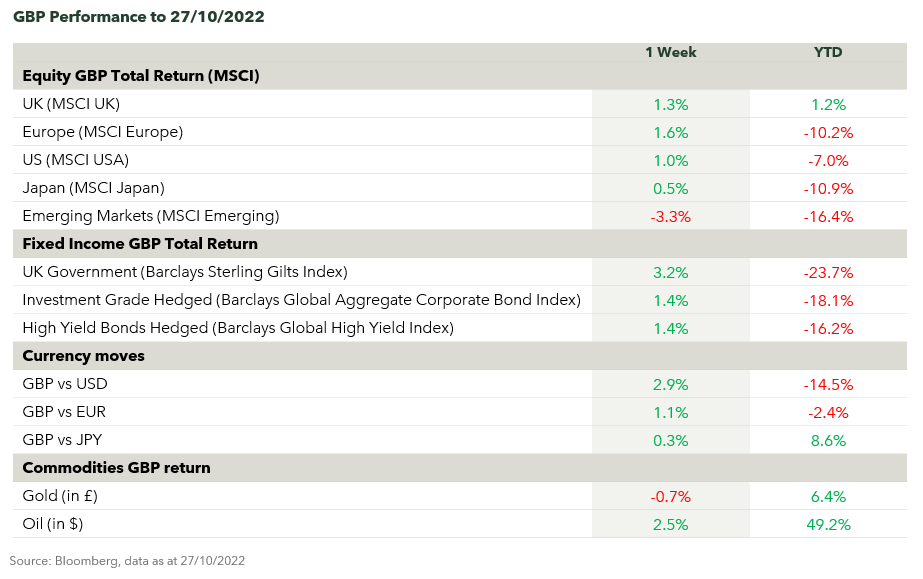

The numbers

The nuance

This week, many companies reported how their businesses are doing in what everyone recognises as a tough environment. There is clear evidence that consumers are under pressure, although this remains mixed with some companies faring better than others.

Ongoing hope of a monetary policy pivot by the Federal Reserve gently supported bonds and equities over the week.

Political volatility reared its head once more, sparked by Xi Jinping's consolidation and concentration of power. We expect that his cabinet reshuffle will last longer than Liz Truss’ did though longer-term policy is uncertain.

The economy is sluggish but there are still winners and losers and some companies continue to operate and produce good results. For example, enterprise application software company SAP SE continues to progress very well as they announced strong cloud growth and a successful transition of their business to a more profitable and defensive mix. Conversely, Meta seems to be struggling with advertising slowdown and the changing social media landscape. Our current focus within the portfolio is to concentrate our investments on companies that are better at dealing with this tougher economic environment.

Quote of the week

“It’s Robo-Rishi.”

Twitter user

It's Robo-Rishi: New PM's 'robot' wave is likened to 'character in a PS2 game' or a 'window wiper' by perplexed Twitter users after he enters Number 10.

Social media was flooded with humorous takes on Rishi Sunak's first greeting from the steps of Number 10 today, with Twitter users noticing his 'awkward' wave. The new Prime Minister posed for the cameras in Downing Street after making his first speech in his coveted role. Standing outside Number 10's famous black door, he turned and waved before disappearing inside to begin work as PM. But viewers online quickly picked up on what they said was his unusual arm movement as he waved to the dozens of cameras and journalists gathered there.

One asked: 'Why does Rishi Sunak wave like a character in a PS2 game.' Another joked that Mr Sunak's wave confirmed he 'is a robot', whilst a fourth said his arm movement looked like a car windscreen wiper that had been 'set to intermittent’. In his speech, Mr Sunak warned that the nation is facing a 'profound economic crisis' and pledged to fix the 'mistakes' of predecessor Liz Truss's leadership. He said it was 'only right to explain why I'm standing here as your new Prime Minister', saying: 'Right now our country is facing a profound economic crisis.’

Mr Sunak said Ms Truss was 'not wrong' to want to drive up growth, describing it as a 'noble aim’. He added: 'But some mistakes were made. Not born of ill-will or bad intentions - quite the opposite in fact. But mistakes nonetheless. 'I've been elected as leader of my party and your Prime Minister in part to fix them - and that work begins immediately.'

Source: The Daily Mail

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested. Any views expressed are based on information received from a variety of sources which we believe to be reliable, but are not guaranteed as to accuracy or completeness by atomos. Any expressions of opinion are subject to change without notice.